TABLE OF CONTENTS

TABLE OF CONTENTS FOR 20162022 ANNUAL MEETING OF STOCKHOLDERS

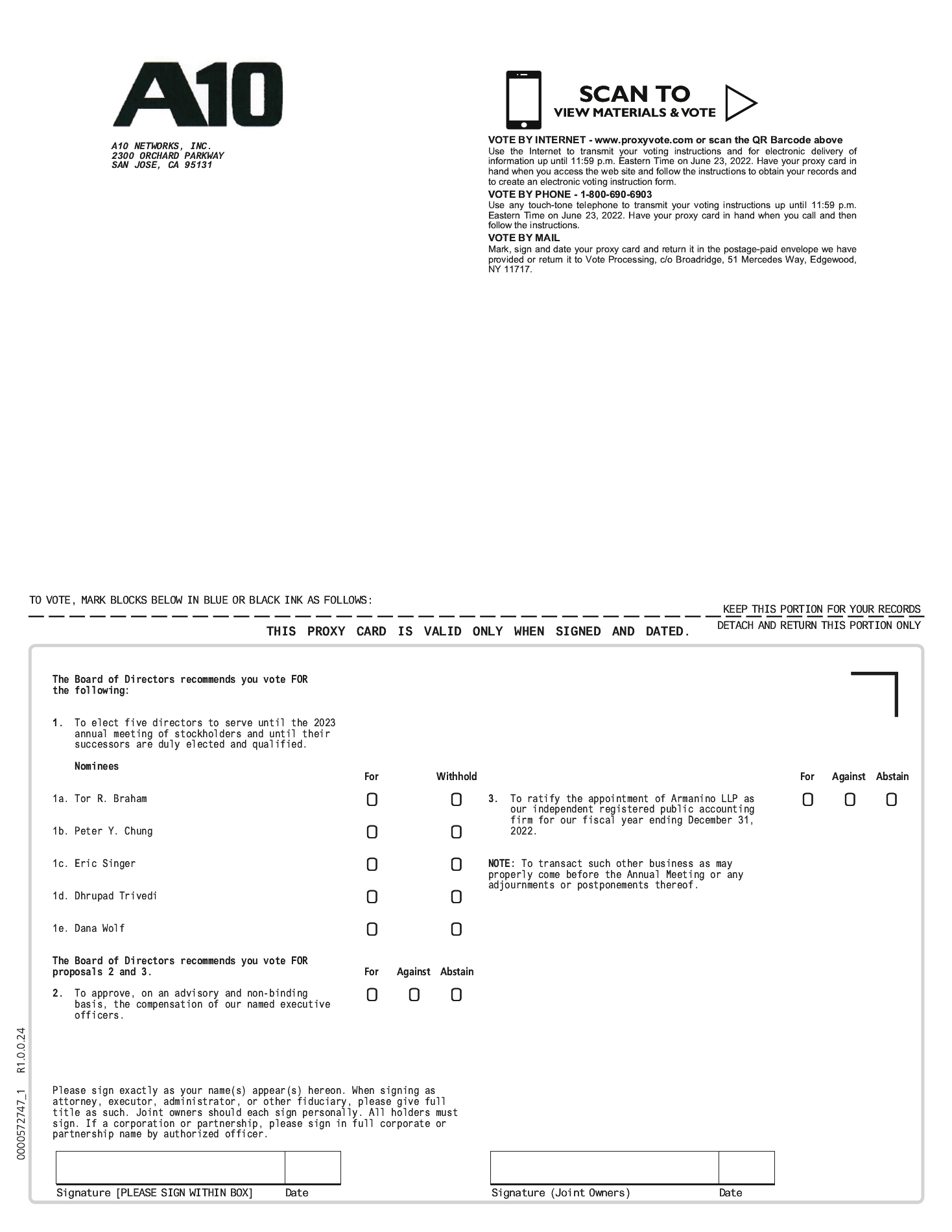

To Be Held at 10:00 a.m. Pacific Time on Wednesday,Friday, June 1, 201624, 2022 This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2016 annual meeting2022 Annual Meeting of stockholders of A10 Networks, Inc., a Delaware corporation (the “Company”), and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Wednesday,Friday, June 1, 201624, 2022 at 10:00 a.m. Pacific Time, at 3 West Plumeria Drive,2300 Orchard Parkway, San Jose, California. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 15, 2016May 11, 2022 to all stockholders entitled to vote at the Annual Meeting. The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only. QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING What matters am I voting on? the election of two Class II directorsthe director nominees named in this proxy statement, to serve until the 20192023 annual meeting of stockholders and until their successors are duly elected and qualified;qualified, subject to earlier resignation or removal; a proposal to approve, on an amendment toadvisory and non-binding basis, the compensation of our 2014 Employee Stock Purchase Plan to remove named executive officers as described in this proxy statement; the automatic annual share increase thereunder and increase the numberratification of shares available for issuance thereunder by 4,000,000 shares; a proposal to ratify the appointment of Deloitte & ToucheArmanino LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016;2022; and

any other business as may properly come before the Annual Meeting. How does the board of directors recommend I vote on these proposals? Our board of directors recommends a vote: “FOR” the election of Peter Y. Chung and Robert Cochran as Class II directors;each of the director nominees; “FOR” the approval, on an advisory and non-binding basis, of an amendment tothe compensation of our 2014 Employee Stock Purchase Plan to remove the automatic annual share increase thereundernamed executive officers as described in this proxy statement; and increase the number of shares available for issuance thereunder by 4,000,000 shares; and “FOR” the ratification of the appointment of Deloitte & ToucheArmanino LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016.2022. Holders of our common stock as of the close of business on April 7, 2016,29, 2022, the record date, may vote at the Annual Meeting. As of the record date, there were 64,486,090 shares75,824,501shares of our common stock outstanding. In deciding all matters at the Annual Meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the record date. We do not have cumulative voting rights for the election of directors.

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting. TABLE OF CONTENTS Street Name Stockholders . If shares of our common stock are held on your behalf in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of those shares held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use. Throughout this proxy, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”How many votes are needed for approval of each proposal? | • | Proposal No. 1: The election of directors requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “for” are elected as the Class II directors. As a result, any shares not voted “for” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “for” or “withhold” on each of the nominees for election as a director. |

| • | Proposal No. 2: The approval of an amendment to our 2014 Employee Stock Purchase Plan to remove the annual share increase thereunder and increase the number of shares available for issuance thereunder by 4,000,000 shares requires the affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon (provided that that vote also constitutes the affirmative vote of a majority of the required quorum). Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of this proposal. |

| • | Proposal No. 3: The ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of this proposal. |

Proposal No. 1: The election of directors requires a plurality of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote, meaning that the nominees who receive the largest number of votes cast “for” their election are elected as directors. As a result, any shares not voted “for” a particular nominee (whether as a result of “withhold” votes or broker non-votes) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “for” or “withhold” on each of the nominees for election as a director. Proposal No. 2: The approval, on an advisory and non-binding basis, of the compensation of our named executive officers as described in this proxy statement requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Abstentions are considered as a vote “against” the proposal because an abstention represents a share entitled to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. You may vote “for,” “against” or abstain” on this proposal. Proposal No. 3: The ratification of the appointment of Armanino LLP requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Abstentions are considered as a vote “against” the proposal because an abstention represents a share entitled to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. You may vote “for,” “against” or abstain” on this proposal. A quorum is the minimum number of shares required to be present at the Annual Meeting for the Annual Meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, in person or represented by proxy, of a majority of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions, withhold votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum. If you are a stockholder of record, there are four ways to vote: | • | by Internet at http://www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. on May 31, 2016 (have your proxy card in hand when you visit the website); |

| • | by toll-free telephone at 1-800-690-6903 (have your proxy card in hand when you call); |

| • | by completing and mailing your proxy card (if you received printed proxy materials); or |

| • | by written ballot at the Annual Meeting. |

by Internet at http://www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on June 23, 2022 (have your proxy card in hand when you visit the website); by toll-free telephone at 1-800-690-6903 (have your proxy card in hand when you call); by completing and mailing your proxy card (if you received printed proxy materials); or by written ballot at the Annual Meeting. If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

TABLE OF CONTENTS Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by: | • | entering a new vote by Internet or by telephone; |

| • | returning a later-dated proxy card; |

| • | notifying the Secretary of A10 Networks, Inc., in writing, at A10 Networks, Inc., 3 West Plumeria Drive, San Jose, California 95134; or |

| • | completing a written ballot at the Annual Meeting. |

entering a new vote by Internet or by telephone; returning a later-dated proxy card; notifying the Secretary of A10 Networks, Inc., in writing, at A10 Networks, Inc., 2300 Orchard Parkway, San Jose, California 95131; or completing a written ballot at the Annual Meeting. If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote. What do I need to do to attend the Annual Meeting in person? If you plan to

To attend the meeting, you must be a holder of Company shares as of the record date of April 7, 2016. Please contact29, 2022. If you plan to attend, please notify the Company to notify of your intention to attend no later than May 31, 2016June 23, 2022 at 6:5:00 p.m. PST (jgarcia@a10networks.com/408-643-8105)Pacific Time by contacting Jaime Garcia (jgarcia@a10networks.com). On the day of the meeting, each stockholderyou may be required to present a valid picture identification such as a driver’s license or passport and you may be denied admission if you do not. Please note that seating is limited. Use of cameras, recording devices, computers and other personal electronic devices will not be permitted at the Annual Meeting. Photography We intend to hold our Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and video are prohibited atsensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so in advance by filing Definitive Additional Materials with the SEC along with notice of the change(s) to the Annual Meeting. Meeting, and details on how to participate will be available at www.proxydocs.com and http://investors.a10networks.com. What is the effect of giving a proxy? Proxies are solicited by and on behalf of our board of directors. Lee Chen, Greg StraughnDhrupad Trivedi, Brian Becker and Robert Cochran have been designated as proxies by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above. Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials? In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnishprovide our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 15, 2016May 11, 2022 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mailemail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetingsstockholder meetings. All stockholders who have previously requested to receive a paper copy of stockholders.the materials, will receive a full set of paper proxy materials by U.S. mail. TABLE OF CONTENTS How are proxies solicited for the Annual Meeting? Our board of directors, isofficers and other employees may be soliciting proxies for use at the Annual Meeting. AllMeeting by personal interview, telephone, facsimile or electronic mail. No additional compensation will be paid to these persons for solicitation and all expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker or other nominee holds shares of our common stock on your behalf. At this time we have not engaged a proxy solicitor. If we do engage a proxy solicitor we will pay the customary costs associated with such engagement. How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions? Brokerage firms and other intermediaries holding shares of our common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of Deloitte & ToucheArmanino LLP. Your broker will not have discretion to vote on the election of directors or the amendment of our 2014 Employee Stock Purchase Plan, each of which is a “non-routine” matter,any other proposal absent direction from you. Where can I find the voting results of the Annual Meeting? We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to thissuch Current Report on Form 8-K as soon as they become available. I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? We have adopted aan SEC-approved procedure called “householding,” which the SEC has approved. Under this procedure, weallows us to deliver a single copy of the Notice and, if applicable, our proxy materials to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at the following address: A10 Networks, Inc.

Attention: Investor Relations 3 West Plumeria Drive

2300 Orchard Parkway

San Jose, California 9513495131

(408) 325-8668 Stockholders who beneficially own shares of our common stock held in street

Street name stockholders may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding. What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at theour next annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion inat our proxy statement for our 20172023 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices notprior to certain deadlines. Those deadlines vary based upon when we actually hold our 2023 annual meeting and also whether the stockholder intends the proposal to be included in our proxy statement for the meeting. TABLE OF CONTENTS Proposals Intended to be Included in our Proxy Statement For a stockholder proposal to be considered for inclusion in our proxy statement for the 2023 annual meeting, our Secretary must receive the written proposal at our principal executive offices no later than December 16, 2016.January 11, 2023. In addition, stockholder proposals must comply with the requirements of SEC Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to: A10 Networks, Inc.

Attention: Secretary 3 West Plumeria Drive

2300 Orchard Parkway

San Jose, California 9513495131 Proposals Not Intended to be Included in our Proxy Statement Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal beforeat an annual meeting of stockholders but who do not intend for the proposal to be included in our proxy statement.statement for the meeting. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before the annual meeting by or at the direction of our board of directors, or (iii) properly brought before the annual meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our amended and restatedthe bylaws. To be timely for our 2017 If we hold the 2023 annual meeting no more than 30 days before or after the one-year anniversary of stockholders,this year’s Annual Meeting, then, for a stockholder proposal to be considered at the 2023 annual meeting, our Secretary must receive the written notice at our principal executive offices: | • | not earlier than January 30, 2017; and |

| • | not later than the close of business on March 1, 2017. |

Inoffices at the event thatabove address:

no earlier than February 25, 2023; and no later than the close of business on March 27, 2023. If we hold our 2017the 2023 annual meeting of stockholders more than 30 days before or more than 30 days after the one-year anniversary of thethis year’s Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statementSecretary must be receivedreceive the written notice no earlier than the close of business on the 120th day before suchthe actual date of the 2023 annual meeting and no later than the close of business on the latterlater of the following two dates: | • | • | the 90th90th day prior to suchthe 2023 annual meeting; or |

| • | • | the 10th10th day following the day on which public announcement ofwe first announce publicly the date of suchthe 2023 annual meeting is first made.meeting. |

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting to present such proposal, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates You may propose director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.” In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, thea stockholder must provide the information required by our amendedbylaws and restated bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Secretary within the time period described above under “Stockholder Proposals” for stockholder proposals that are not intended“—Proposals Not Intended to be includedIncluded in a proxy statement.our Proxy Statement.” You may contact our Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. TABLE OF CONTENTS BOARD OF DIRECTORS AND CORPORATE GOVERNANCE Our business affairs are managed under the direction of our board of directors, which is currently composed of five members. Threemembers and has the following characteristics: Director Independence. 4 of ourthe 5 individuals currently serving as directors are independent within the meaning of the listing standards of the New York Stock Exchange. Director Diversity. 60% of our directors currently self-identify as being from one or multiple diverse groups, including gender. Director Tenure. Our directors are not long service. 3 of 5 directors have less than 3 years of tenure. The average tenure of our directors is approximately 4 years. Director Age. Average age of our directors is approximately 57 years. Director Skills. Our directors have the following diverse experiences and perspectives in areas that are critical to the success of our business and to the creation of sustainable stockholder value: industry, finance, supply chain: human rights and environmental sustainability, operations, risk management including cybersecurity, executive compensation and human capital management, ESG, global leadership, banking and M&A, and public board experience. On April 26, 2021, director Mary Dotz notified our board of directors is divided into three staggered classesthat she would not stand for re-election at the Annual Meeting. Following receipt of directors. At eachsuch notice, on April 26, 2021, our board of directors nominated Dana Wolf to stand for election to the Board at the Annual Meeting, to serve until the 2023 annual meeting of stockholders a classand until her successor is duly elected and qualified, subject to earlier resignation or removal. Four of the five individuals currently serving as directors will be elected for a three-year term to succeedare independent within the same class whose termmeaning of the listing standards of the New York Stock Exchange, as is then expiring.nominee Dana Wolf. The following table sets forth the names, ages as of April 7, 2016, and certain other information for each of theour directors with terms expiring at the annual meeting (who are alsoand director nominees for election as a director at the annual meeting) and for each of the continuing members of our board of directors:| | | | | | | | | | | | | | | | | Class | | Age | | Position | | Director

Since | | Current

Term

Expires | | Expiration

of Term

For Which

Nominated | | Directors with Terms expiring at the Annual Meeting/Nominees | | | | | | | | | | | | | | | | | | | | | | | | | | | | Peter Y. Chung(1)(2)(3) | | II | | 48 | | Director | | 2013 | | 2016 | | 2019 | | Robert Cochran | | II | | 58 | | Vice President, Legal and CorporateCollaboration and Secretary and Director | | 2012 | | 2016 | | 2019 | | Continuing Directors | | | | | | | | | | | | | | Lee Chen | | III | | 62 | | Chief Executive Officer, President and Chairman | | 2004 | | 2017 | | | | Alan S. Henricks(1)(2)(3) | | III | | 65 | | Director | | 2014 | | 2017 | | | | Phillip J. Salsbury(1)(2)(3) | | I | | 73 | | Director | | 2013 | | 2018 | | |

Dhrupad Trivedi | | | 55 | | | 2019 | | | President, Chief Executive Officer and Chairperson | Tor R. Braham(1)(2) | | | 64 | | | 2018 | | | Director | Peter Y. Chung(1)(2)(3) | | | 54 | | | 2013 | | | Director | Mary Dotz(1) | | | 64 | | | 2020 | | | Director | Eric Singer(2)(3) | | | 48 | | | 2019 | | | Director | Dana Wolf | | | 47 | | | | | | Director Nominee |

| (1)

| Member of our audit committee |

| (2)

| Member of our compensation committee |

| (3)

| Member of our nominating and corporate governance committee |

Dhrupad Trivedi joined A10 Networks in December 2019 as president and chief executive officer. Mr. Trivedi was also appointed as a member of our board of directors in December 2019 and as Chairperson of the board in September 2020. From March 2013 to November 2019, Dr. Trivedi served as President, Network Solutions – Industrial IT/IOT and Cybersecurity at Belden Inc., a manufacturer of networking, connectivity, and cable products, and also served as a corporate vice president from January 2010 to March 2013. Prior to this, he held multiple general management and corporate development roles at JDS Uniphase. Trivedi holds a Ph.D. in electrical engineering from University of Massachusetts, Amherst, a master’s degree in electrical engineering from University of Alabama and an MBA in finance from Duke University. Trivedi brings global leadership experience across multiple businesses and is passionate about driving leading technology businesses to win by creating value for customers. Tor R. Braham has served as a member of our board of directors since March 2018. He is currently also a director of Viavi Solutions Inc., a network and service enablement and optical coatings company. Mr. Braham is also Of Counsel to the law firm of King, Holmes, Paterno and Soriano. He previously served as a member of the board of directors of Yahoo!, a provider of web services from April 2016 to June 2017, Altaba, Inc a publicly traded

TABLE OF CONTENTS investment company from June 2017 to December 2021, NetApp, Inc., a computer storage and data management company, from September 2013 to March 2016, Sigma Designs, Inc., an integrated circuit provider for the home entertainment market, from June 2014 to August 2016, Live Oak Acquisition Corp from February 2020 to December 2020, and Live Oak Acquisition Corp II, from December 2020 to October 2021. Mr. Braham served as Managing Director and Global Head of Technology Mergers and Acquisitions for Deutsche Bank Securities Inc., an investment bank, from 2004 until November 2012. From 2000 to 2004, he served as Managing Director and Co-Head of West Coast U.S. Technology, Mergers and Acquisitions for Credit Suisse First Boston, an investment bank. Prior to that role, Mr. Braham served as an investment banker with Warburg Dillon Read LLC and as an attorney at Wilson Sonsini Goodrich & Rosati. Mr. Braham has specific attributes that qualify him to serve as a member of our board of directors, including his extensive financial experience and knowledge of the technology industry gained through his service as an investment banker and lawyer to technology companies, as well as his service on public and private company boards. Peter Y. Chung has served as a member of our board of directors since June 2013. Mr. Chung is a managing directorManaging Director and the chief executive officerChief Executive Officer of Summit Partners, L.P., where he has been employed since 1994. He is currently a director of M/A-COMMACOM Technology Solutions Holdings, Inc., a provider of semiconductor solutions for use in radio frequency, microwave and millimeter wave applications, as well as several privately-held companies. Previously, Mr. Chung previously served as a directormember of Ubiquiti Networks, Inc., a company that develops networking technology.the board of directors of Acacia Communications. Mr. Chung has an M.B.A. from the Stanford University Graduate School of Business and an A.B. in Economics from Harvard University. Mr. Chung has specific attributes that qualify him to serve as a member of our board of directors, including his experience in investment banking, private equity and venture capital investing and in the communications technology sector, as well as his prior service on public and private company boards.Robert Cochran has served as our Vice President, Legal and Corporate Collaboration since January 2012 and as a member of our board of directors since April 2012. Mr. Cochran has served as our Secretary since August 2004, and previously served on our board of directors from August 2004 to October 2004. From January 1993 to January 2012, Mr. Cochran was an attorney in private practice in Woodside, California, where he had served as our outside legal counsel since our incorporation. From 2004 to 2010, Mr. Cochran served as a director of Techwell, Inc., a fabless semiconductor public company that was acquired by Intersil Corporation. Mr. Cochran also serves as a director of two privately-held companies. Mr. Cochran has a J.D. from Harvard Law School and an A.B. in Economics from Harvard University. Mr. Cochran has specific attributes that qualify him to serve as a member of our board of directors, including the perspective and experience he has acquired from counseling growth companies over the last thirty years, and his prior service on public and private company boards.

Continuing Directors

Lee Chen has served as our President, Chief Executive Officer and as a member of our board of directors since July 2004, and as the Chairman of our board of directors since March 2014. From 1996 to August 2004, Mr. Chen served in a variety of positions, including as Vice President of Software Engineering and Quality Assurance at Foundry Networks, Inc., a company that designed, manufactured and sold high-end enterprise and service provider switches and routers, as well as wireless, security, and traffic management solutions. Mr. Chen has previously held management and senior technical positions at OTS, Apple Computer, Convergent Technologies, Inc. and InSync Group, and was a co-founder of Centillion Networks, Inc. Mr. Chen has an M.S.E.E. from San Jose State University and a B.S. in Electrophysics from National Chiao-Tung University in Taiwan. Mr. Chen is a technology pioneer, especially in the area of Internet Protocol Multicast and System & System Security and holds numerous patents. Mr. Chen has specific attributes that qualify him to serve as a member of our board of directors, including the perspective and experience he brings as our Chief Executive Officer and President, one of our founders and a significant stockholder.

Eric SingerAlan S. Henricks has served as a member of our board of directors since March 2014. Since May 2015 he has servedJuly 2019 and as our lead independent director since September 2021. Mr. Singer is a founder and Managing Member of VIEX Capital Advisors, a securities investment firm. In addition to a long track record as a membersuccessful investor in technology companies, Mr. Singer has substantial experience serving on public boards and in assisting them in creating and expanding shareholder value. Mr. Singer is currently a director of Immersion Corporation , a developer and licensor of touch feedback technology company, and previously served on the boardboards of directors of Quantum Corporation, a video data storage and audit committee of Model N, Inc. (NYSE: MODN)management company, Numerex Corp., a provider of cloud-based Revenue Management solutions. From November 2014 to May 2015 he has served asmanaged machine-to-machine enterprise solutions enabling the Internet of Things, RhythmOne plc and YuMe, Inc., each a memberprovider of the board of directorsbrand video advertising software and audit committee chairman of APT Software Holdings.From April 2010 to June 2015 he served as a member of the board of directors of Ellie Mae, Inc. (NYSE: ELLI)audience data, Support.com , a SaaS Company, and as its lead independent director from November 2012 to May 2014. Since May 2012 he has served as a member of the board of directors and audit committee chairman of Roku, Inc., a consumer electronics company. From May 2009 toprovider of tech support and support center services, Meru Networks, Inc., a Wi-Fi network solutions company, PLX Technology, Inc., a PCI Express and ethernet semiconductor company, and Sigma Designs, Inc., an integrated circuit provider for the present,home entertainment market, among other companies. Mr. HenricksSinger has been a board member, advisor and consultant to a variety of private technology companies. His consulting CFO roles included Tile, Inc., Livescribe Inc. and Santur Corporation. From September 2006 to May 2009, Mr. Henricks served as Chief Financial Officer of Pure Digital Technologies, Inc. Prior to September 2006, Mr. Henricks served as Chief Financial Officer of several private and public companies including Traiana Inc., Informix Software, Inc., Documentum, Inc., Borland International, Inc., Cornish & Carey and Maxim Integrated Products, Inc. Mr. Henricks holds a Bachelor of Science in EngineeringB.A. from the Massachusetts Institute of Technology and a Master of Business Administration from StanfordBrandeis University. Mr. HenricksSinger has specific attributes that qualify him to serve as a member of our board of directors, including his extensive financial and operating experience serving as chief financial officerand knowledge of both public and private companies, as well asthe technology industry gained through his prior service on numerous public and private company boards.Dr. Phillip J. Salsbury has

Dana Wolf is an entrepreneur in the security space. From August 2017 to November 2021 she served as a memberSenior Vice President of our board of directors since May 2013. Dr. Salsbury is also our Lead Independent Director. From 2005 to April 2010, Dr. Salsbury served as a director of Techwell,Product & Marketing at Fastly Inc., a fabless semiconductor publicglobal edge cloud network provider. From August 2013 to August 2017, she was the Head of Product for the cloud security product lines at OpenDNS, Inc. (acquired by Cisco Systems, Inc.), a company that was acquired by Intersil Corporation. Dr. Salsbury was a founder,providing domain name system resolution services. Ms. Wolf has over 18 years of experience in the Chief Technology Officer,security space, holding both product and later the president and Chief Executive Officer of SEEQ Technology,engineering leadership roles at both Rapid7, Inc., a non-volatile memorycyber security analytics and Ethernet communications semiconductorautomation services company, from January 1981 until its acquisition by LSI Logic Corporation,and RSA Security LLC, a large semiconductorcomputer and network security company in June 1999. Hewith a focus on protecting and managing online identities and digital assets. Ms. Wolf holds a Ph.D.B.A. from Lawrence University in Mathematics, Computer Science and Theatre and an M.S. in Electrical EngineeringM.B.A. (High Tech) from Stanford University and a B.S. in Electrical Engineering from theUniversity of Michigan. Dr. SalsburyNortheastern University. Ms. Wolf has specific attributes that qualify himher to serve as a member of our board of directors, including his strong technical backgroundher extensive experience in the cyber security industry and management experience as chief executive officer of a public company, and his prior service as a director of a public company.

cloud-based businesses. Our common stock is listed on the New York Stock Exchange. Under the listing standards of the New York Stock Exchange, independent directors must comprise a majority of a listed company’s board of directors. In addition, the listing standards of the New York Stock Exchange require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the listing standards of the New York Stock Exchange, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

TABLE OF CONTENTS Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the listing standards of the New York Stock Exchange. In addition, Compensationcompensation committee members must also satisfy the independence criteria set forth under the listing standards of the New York Stock Exchange. Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his background, employment and affiliations, our board of directors has determined that Messrs. Chung, Henricksall of our directors other than Mr. Trivedi, our chief executive officer, are “independent” as that term is defined under the listing standards of the New York Stock Exchange and Salsbury do not have a relationshipany relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the listing standards of the New York Stock Exchange.director. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Related PartyPerson Transactions.”

Board Leadership Structure The Board is committed to strong, independent Board leadership and oversight of management’s performance. In addition to having substantially all of its members be independent under applicable listing standards and SEC standards, our current Board includes an affiliate from our largest stockholder as of March 31, 2022. The Board believes that whether to have the same person occupy the offices of Chairperson of the Board and Chief Executive Officer should be decided by the Board, from time to time, in its business judgment after considering relevant factors, including the specific needs of the business and what is in the best interests of our stockholders. If the Chairperson is an employee, the Board may appoint a lead independent director to help ensure robust independent leadership on the Board. The Chairperson of the Board has the powers and duties customarily and usually associated with the office of the chairperson of the board, including setting the schedule and agenda for Board meetings and presiding at meetings of the Board and meetings of our stockholders, unless a Chairperson of a stockholder meeting is otherwise appointed by the Board. The Chairperson also has the authority to call special meetings of our stockholders. If our Chairperson is an independent, non-employee director, the Chairperson has the responsibilities of the lead independent director. Mr. ChenTrivedi currently serves as both chairChairperson of our Boardboard of Directorsdirectors and our chief executive officer.Chief Executive Officer. Our Boardboard believes that the current Boardboard leadership structure provides effective independent oversight of management while allowing our Board of Directorsboard and management to benefit from Mr. Chen’sTrivedi’s leadership and years of experience as an executive in themultiple global high technology industries including networking, industry.cloud, IOT and cybersecurity. Mr. ChenTrivedi is best positioned to identify strategic priorities, lead critical discussion and execute our strategy and business plans. Mr. ChenTrivedi possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing us.our company. Lead Independent Director Our Board determined that it would be beneficiallead independent director has the responsibility to have a Lead Independent Director to, among other things, preside over executive sessionsschedule and prepare agendas for meetings of the outside directors. The lead independent directors, which providesdirector may communicate with our Chief Executive Officer, disseminate information to the rest of the Board in a timely manner, raise issues with management on behalf of the benefitoutside directors when appropriate, and facilitate communications between management and the outside directors. In addition, the lead independent director may have other responsibilities, including calling meetings of havingoutside directors when necessary and appropriate, being available, when appropriate, for consultation and direct communication with our stockholders, building a productive relationship between the perspective of entirely independent directors. Independent directorsBoard and management sometimes have different perspectivesthe Chief Executive Officer, ensuring the Board fulfills its oversight responsibilities in our strategy, risk oversight and roles in strategy development.Oursuccession planning, and performing such other duties as the Board appointed Phillip J. Salsbury, Ph.D.may from time to servetime designate.

Mr. Singer serves as our lead independent director. As lead independent director, Dr. SalsburyIn this role, Mr. Singer presides over periodic meetings of our independent directors, serves as a liaison between our Chairmanchairperson of the board of directors and the independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate.

Board Meetings and Committees During our fiscal year ended December 31, 2015,2021, the board of directors held five (5) meetings (including regularly scheduled and special meetings) and acted by written consent one (1) time. Eachfour (4) times. Throughout the year, directors met frequently to discuss our operations, the impact of Covid-19 on our business, strategic matters and other business. TABLE OF CONTENTS In many instances, these meetings resulted in formal board action approved by unanimous written consent. In other instances, these meetings resulted in our board of directors providing input to our management team throughout the year. No director attended at least 85%fewer than 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served. Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend. Four (4)All five of our directors attended our 20152021 annual meeting of stockholders. Our board of directors has established three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each of thethese committees of our board of directors is described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

The audit committee is currently comprised of Messrs. Braham, Chung Henricks and Salsbury, each of whomMs. Dotz. Ms. Dotz is a non-employee member of our board of directors. Mr. Henricks iscurrently the chair of ourthe audit committee. Our board of directors has determined that each of the members of our auditthis committee satisfies the requirements for independence and financial literacy under the applicable rules and regulations of the New York Stock Exchange and the SEC. Our board of directors has also determined that Mr. Henricks qualifiesChung and Ms. Dotz each qualify as an “audit committee financial expert” as defined in the SEC rules and satisfieseach satisfy the financial sophistication requirements of the New York Stock Exchange. The audit committee is responsible for, among other things: selecting and hiring our registered public accounting firm; evaluating the performance and independence of our registered public accounting firm; approving the audit and pre-approving any non-audit services to be performed by our registered public accounting firm; reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices; reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures; overseeing procedures for the treatment of complaints on accounting, internal accounting controls, or audit matters; overseeing, monitoring and coordinating with regard to risk management, including those relating to enterprise risk management (ERM) and cybersecurity; reviewing and discussing with management and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements, and our publicly filed reports; reviewing and approving in advance any proposed related person transactions; and preparing the audit committee report to be included in our annual proxy statement as required by the SEC. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and the New York Stock Exchange. A copy of the charter of ourthe audit committee is available on our website at http://investors.a10networks.com. During 2015, our2021, the audit committee held seven (7)four (4) meetings and did not actacted by written/electronic consent.written consent one (1) time. Compensation Committee Our

The compensation committee currently consists of Messrs. Braham, Chung, Henricks and Salsbury.Singer. Mr. Chung is the chairmanchair of ourthe compensation committee. Our board of directors has determined that each member of this committee is independent under the applicable rules and regulations of the New York Stock Exchange and the SEC, a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended, or Section 162(m).amended. TABLE OF CONTENTS The compensation committee is responsible for, among other things: reviewing and approving our Chief Executive Officer’s and other executive officers’ annual base salaries, incentive compensation plans, including the specific goals and amounts, equity compensation, employment agreements, severance arrangements and change in control agreements, and any other benefits, compensation or arrangements; evaluating director compensation and making recommendations to the board of directors regarding such compensation; administering our equity compensation plans; overseeing our overall compensation philosophy, compensation plans, and benefits programs; and preparing the compensation committee report to be included in our form 10-K or annual proxy statement as required by the SEC. Our

The compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the New York Stock Exchange. A copy of the charter of ourthe compensation committee is available on our website at http://investors.a10networks.com. During 2015, our2021, the compensation committee held six (6)four (4) meetings and acted by written/electronicwritten consent one (1) time.eight (8) times. Nominating and Corporate Governance Committee Our

The nominating and corporate governance committee currently consists of Messrs. Chung, Henricks and Salsbury, each of whom is a non-employee member of our board of directors. Dr. SalsburySinger. Mr. Singer is the chairmanchair of ourthe nominating and corporate governance committee. Our board of directors has determined that each member of our nominating and corporate governancethis committee meets the requirements for independence under the rules of the New York Stock Exchange. The nominating and corporate governance committee is responsible for, among other things: evaluating and making recommendations regarding the composition, organization, and governance of our board of directors and its committees; evaluating and making recommendations regarding the development, oversight, and implementation of the Company’s Environmental, Social, and Governance (“ESG”) policies, programs, and practices; evaluating and making recommendations regarding the policies, programs, practices, and reports concerning ESG, including sustainability, environmental protection, community and social responsibility, and human rights; evaluating and making recommendations regarding the creation of additional committees or the change in mandate or dissolution of committees; reviewing and making recommendations with regard to our corporate governance guidelines and compliance with laws and regulations; and reviewing actual and potential conflicts of interest of our directors and corporate officers, other than related person transactions reviewed by the audit committee and approving or prohibiting any involvement of such persons in matters that may involve a conflict of interest. Our

The nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of the New York Stock Exchange. A copy of the charter of ourthe nominating and corporate governance committee is available on our website at http://investors.a10networks.com. During 2015, our2021, the nominating and corporate governance committee held twothree (3) meetings and did not act by written/electronic consent. Our nominating and corporate governance committee held a meeting in the first quarter of 2016 and acted by written consent in April of 2016 in connection with its recommendation of Messrs. Chung and Cochran as nominees for election as the Class II directors at the Annual Meeting.one (1) time. Compensation Committee Interlocks and Insider Participation Messrs. Braham, Chung Henricks and SalsburySinger are the current members of our compensation committee. None of the members of our compensation committee is or has been one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the compensation committee or director (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving on our compensation committee or our board of directors. TABLE OF CONTENTS Considerations in Evaluating Director Nominees Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, diversity (including, but not limited to, diversity of experience,gender, ethnicity, race, international background and life experience), independence, area of expertise, corporate experience, length of service, potential conflicts of interest and other commitments. Nominees must also have the ability to offer advice and guidance to our Chief Executive Officer based on past experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Director candidates must have sufficient time available in the judgment of our nominating and corporate governance committee to perform all board of director and committee responsibilities. Members of our board of directors are expected to prepare for, attend, and participate in all board of director and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests. Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that our board of directors should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee may take into account the benefits of diverse viewpoints. Our nominating and corporate governance committee also considers these and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. The Company is committed to diversity at all levels, including with our directors, and our nominating and corporate governance committee is committed to considering diversity, including gender diversity, in identifying future candidates for nomination to the board. Sixty percent of our directors self-identify as being from one or multiple diverse groups. Stockholder Recommendations for Nominations to the Board of Directors Our nominating and corporate governance committee will consider candidates for director recommended by stockholders holding at least one percent (1%) of the fully diluted capitalization of the company continuously for at least twelve (12) months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation currently in effect and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. The nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our General Counsel or our Legal DepartmentSecretary in writing. Such recommendations must include, amongst other things provided in our Bylaws, information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors. Any nomination should be sent in writing to our General Counsel or our Legal DepartmentSecretary at A10 Networks, Inc., 3 West Plumeria Drive,2300 Orchard Parkway, San Jose, CA 95134. To be timely for our 201795131. If we hold the 2023 annual meeting of stockholders no more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, then our General Counsel or Legal DepartmentSecretary must receive the written nomination; no earlier than February 25, 2023; and no later than the close of business on March 27, 2023.

TABLE OF CONTENTS If we hold the 2023 annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, then our Secretary must receive the written nomination no earlier than January 30, 2017the close of business on the 120th day before the actual date of the 2023 annual meeting and no later than March 1, 2017.the close of business on the later of the following two dates: | • | the 90th day prior to the 2023 annual meeting; or |

| • | the 10th day following the day on which we first announce publicly the date of the 2023 annual meeting. |

Communications with the Board of Directors Interested parties wishing to communicate with our board of directors or with an individual member or members of our board of directors may do so by writing to our board of directors or to the particular member or members of our board of directors, and mailing the correspondence to our General Counsel at A10 Networks, Inc., 3 West Plumeria Drive,2300 Orchard Parkway, San Jose, CA 95134,95131, Attn: General Counsel. Each communication should set forth (i) the name and address of the stockholder, as it appears on our books, and if the shares of our common stock are held by a nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner. Our General Counsel, in consultation with appropriate members of our board of directors as necessary, will review all incoming communications and, if appropriate, forward such communications will be forwarded to the member or members of our board of directors to whom such communication wascommunications were directed, or if none is specified, to the ChairmanChairperson of our board of directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics is posted on the Corporate Governance portion of our website under Governance Documents at http://investors.a10networks.com. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers on the same website.

Hedging and Pledging Pursuant to our Insider Trading Policy, all employees (including directors) are prohibited from engaging in transactions in publicly traded options and other derivative securities with respect to our common stock, including any hedging or similar transaction designed to decrease the risks associated with holding company securities. Our directors and named executive officers are also prohibited from pledging company securities as collateral or holding company securities in a margin account. Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed. Our board of directors believes that open communication between management and our board of directors is essential for effective risk management and oversight. Our board of directors meets with our Chief Executive Officer and other members of the senior management team at quarterly meetings of our board of directors, where, among other topics, they discuss strategy and risks facing the company, as well as at such other times as they deemed appropriate. TABLE OF CONTENTS While our board of directors is ultimately responsible for risk oversight, our board committees assist our board of directors in fulfilling its oversight responsibilities in certain areas of risk. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting, and disclosure controls and procedures, legal and regulatory compliance and cybersecurity, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. Our audit committee also monitors certain key risks on a regular basis throughout the fiscal year, such as riskrisks associated with internal control over financial reporting and liquidity risk. Our nominating and corporate governance committee assists our board of directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our compensation committee assesses risks created by the incentives inherent in our compensation policies. Finally, our full board of directors reviews strategic and operational risk in the context of reports from the management team, receives reports on all significant committee activities at each regular meeting, and evaluates the risks inherent in significant transactions. Cybersecurity A10 is committed to providing networking solutions that enable next-generation networks focused on reliability, availability, scalability and cybersecurity. As cyber-attacks increase in volume and complexity, we integrate security as a key attribute in our solutions that further enable our customers to continue to adapt to market trends in cloud, internet of things and the ever increasing need for more data, building upon our strong global footprint and leadership in application and network infrastructure. Our board of directors is responsible for overseeing cybersecurity and data protection strategy. Management regularly reports any risk exposure to the Board as well as the steps taken to monitor and control them. Corporate Social Responsibility We are committed to maintaining the highest standards of ethics and corporate governance, to fostering a diverse and inclusive workforce, and to reducing our environmental impact. We believe these practices will deliver the highest value for our employees, customers, partners and shareholders. For this reason, we have an ESG policy to ensure that our Company is working towards continuing to a sustainable future in the following areas: Environment We are committed to business practices that preserve the environment upon which our society and economy depend. We are committed to meeting or exceeding all legal and compliance guidelines for our people, products, and operations. In addition, we strive to deliver products and services that minimize the impact to the environment throughout our value chain. We are evaluating environmental initiatives to further develop the Company’s policy and objectives. One such initiative is a sustainability project for reducing carbon emissions. We have engaged with a sustainability expert and set a baseline target year in 2019 for a 10-year carbon reduction plan. The strategy for this project is aligned with the 1.5°C initiative scope protocols. Our corporate headquarters in San Jose, California is compliant with the California Building Energy Efficiency Standards - Title 24 to reduce wasteful and unnecessary energy consumption. We have planned for greater use of renewable energy in partnership with the local utility, PG&E. At our headquarters, we offer EV charging stations to our employees and visitors, and where applicable according to local requirements, we offer recycling and properly dispose of e-waste, Under our Conflicts Material Supply Chain Policy, we expect our suppliers to comply with our policy on responsible sourcing of minerals from conflict-affected and high-risk areas and to cooperate with our diligence inquiries and requests for information and certification as may be required to comply with reporting and disclosure obligations. TABLE OF CONTENTS Social We believe in fostering a diverse and inclusive environment for employees, as well as encouraging diversity and inclusion within the customer and partner ecosystem, and our community at large. We strive to create a corporate culture that values diverse backgrounds and innovative thinking. We have implemented Diversity, Equal Opportunity, and Inclusion action planning teams focused on analysis from diversity surveys and focus groups. We offer a variety of training programs, such as engineering and product line management training, individual career development and coaching, training for sales and marketing and internship programs. Our training and employment opportunities aim to address both our business needs as well as employee growth. We are committed to providing a work environment free from unlawful harassment and we prohibit all employees from engaging in harassment whether directed toward other employees or non-employees with whom we have a business, service, or professional relationship. Periodic training on our code of conduct and harassment policies is required. We strive to be compliant with data privacy statutes globally. As a network security vendor, we are constantly reviewing and applying security best practices. This includes onsite physical security of buildings and employees. The health and well-being of our employees has always been and continues to be a top priority. To ensure the health and well-being of all of our employees during the COVID-19 pandemic, we have taken the following measures: | ○ | Implemented work-from-home and social distancing policies for our organization; |

| ○ | Taken steps to ensure employee’s ability to remotely work-from-home when feasible; |

| ○ | Placed restrictions on travel by our employees and in-person meetings; and |

| ○ | Prepared our San Jose, CA headquarters facility to be compliant with all local and statewide COVID-19 requirements for those essential workers that are unable to work-from-home. |

We offer an attractive and competitive mix of compensation and benefit plans to support our employees and their families’ physical, mental, and financial well-being. We believe that we employ a fair and merit-based total compensation system for our employees. Employees are generally eligible for medical, dental, vision, wellness and other comprehensive benefits, most of which become effective on their start date. It is important that all employees have an opportunity to have an ownership interest in our Company, and there are several programs that provide employees with the ability to own our stock. Generally, more than 75% of our employees participates in at least one of our stock programs, which almost all employees can participate in. Our discounted stock purchase program helps to build an employee ownership and inclusion mentality. Governance We are committed to building strong corporate governance guidelines based on best practices, changing requirements, and feedback from employees, customers, partners, vendors and shareholders. We have an independent and diverse board comprised of members from variety of industries and backgrounds that aspires to best practice corporate governance features. We have established standards and practices to which our board members, executives and employees are obligated to adhere, as outlined in the Code of Business Conduct and Ethics, Corporate Governance Guidelines, Conflicts Mineral Supply Chain Policy, Whistleblower Policy, the Employee Handbook, and our Insider Trading Policy. Shareholder input is important to us in designing our executive compensation philosophy and program. See “Listening to Our Shareholders.” TABLE OF CONTENTS Equity Compensation.Compensation Each non-employee director who first joins usour board of directors will be granted an initial equity award with a value of $225,000 and$225,000. On the date of each annual meeting of stockholders, each continuing non-employee director will be granted an annual equity award with a value of $150,000 on each of our annual stockholder meetings.$150,000. However, a continuing non-employee director who, as of the date of our annual stockholder meeting, has not served as a board member for the entire 12-month period prior to the annual stockholder meeting will receive an annual award with a value that is prorated based on the number of months the director served during the prior year. The initial and annual equity awards will be granted in the form of restricted stock units, and the number of shares to be granted pursuant to such equity awards will be determined by the closing price of a share of our sharescommon stock on the New York Stock Exchange on the grant date. However, aA non-employee director who is not continuing as a director following an annual stockholder meeting will not receive an annual equity award at such meeting. The initial equity award will be scheduled to vest in three, equal, annual installments from the date the non-employee director joins our board of directors, subject to continued service as a board memberwith us through each such date. Each annual equity award will vest as to 100% of the underlying shares on the earlier of the one yearone-year anniversary of the award’s grant date or the date of our next annual stockholder meeting, subject to continued service as a board memberwith us through such date.

Cash Compensation.Compensation Our board of directors approved the following annual compensation package for our non-employee directors: | | | | | | | Annual Cash

Retainer | | | Annual retainer | | $ | 30,000 | | | Additional retainer for audit committee chair | | $ | 20,000 | | | Additional retainer for audit committee member | | $ | 7,500 | | | Additional retainer for compensation committee chair | | $ | 12,000 | | | Additional retainer for compensation committee member | | $ | 5,000 | | | Additional retainer for nominating and governance committee chair | | $ | 7,500 | | | Additional retainer for nominating and governance committee member | | $ | 3,500 | | | Additional retainer for non-executive chairman of the board of directors | | $ | 30,000 | | | Additional retainer for independent lead director | | $ | 15,000 | |

Annual retainer | | | 30,000 | Additional retainer for audit committee chair | | | 20,000 | Additional retainer for audit committee member | | | 7,500 | Additional retainer for compensation committee chair | | | 12,000 | Additional retainer for compensation committee member | | | 5,000 | Additional retainer for nominating and governance committee chair | | | 7,500 | Additional retainer for nominating and governance committee member | | | 3,500 | Additional retainer for non-executive chairperson of the board of directors(1) | | | 30,000 | Additional retainer for independent lead director | | | 15,000 |

(1)

| During 2021, we had an executive chairperson of the board. Accordingly, no payment was made in relation to this position in 2021. |

Director Compensation for 20152021 The following table provides information regarding the total compensation that was paid by the Company to each of our non-employee directors who was not serving as an executive officer in 2015.| | | | | | | | | | | | | | | | | | | Director | | Fees

Earned

or Paid in

Cash ($) | | | Option

Awards

($)(1) | | | Stock

Awards

($)(1)(2) | | | Total ($) | | | Peter Y. Chung | | $ | 39,750 | | | | — | | | $ | 149,999.70 | | | $ | 189,749.70 | | | Alan S. Henricks | | $ | 58,500 | | | | — | | | $ | 149,999.70 | | | $ | 208,499.70 | | | Phillip J. Salsbury | | $ | 65,000 | | | | — | | | $ | 149,999.70 | | | $ | 214,999.70 | |

Tor R. Braham | | | 42,500 | | | 149,999 | | | 192,499 | Peter Y. Chung | | | 53,000 | | | 149,999 | | | 202,999 | J. Michael Dodson(3) | | | 16,667 | | | 0 | | | 16,667 | Mary Dotz | | | 45,859 | | | 49,994 | | | 95,853 | Eric Singer | | | 57,500 | | | 149,999 | | | 207,499 |

TABLE OF CONTENTS | (1)

| The aggregate number of option awards andshares of our common stock subject to stock awards outstanding at December 31, 20152021, for each non-employee director is as follows:below. There were no outstanding stock options held by non-employee directors as of December 31, 2021: |

| | | | | | | | | | | Aggregate Number

of Option Awards

Outstanding at

December 31, | | | Aggregate Number

of Stock Awards

Outstanding at

December 31, | | | Name | | 2015(#) | | | 2015(#) | | | Peter Y. Chung | | | — | | | | 23,622 | | | Alan S. Henricks | | | 30,000 | | | | 23,622 | | | Phillip J. Salsbury | | | — | | | | 37,789 | * |

Tor R. Braham | | | 16,949 | Peter Y. Chung | | | 16,949 | Mary Dotz | | | 20,515 | Eric Singer | | | 26,989 |

| (2)

| The amount reported in the Stock Awards column is the aggregate grant date fair value of the stock award, computed in accordance with equity compensation provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. As required by the rules of the SEC, the amount shown excludes the impact of estimated forfeitures related to service-based vesting conditions. Note that the amount reported in this column does not correspond to the actual economic value that may be received by the director from the award. |

(3)

| Mr. Dodson resigned from the board of directors in May 2021. |

TABLE OF CONTENTS Our board of directors is currently composed of five members. In accordance with our amended and restated certificate of incorporation,On April 26, 2021, director Mary Dotz notified our board of directors is divided into three staggered classesthat she would not stand for re-election at the Annual Meeting. Following receipt of directors.such notice, on April 26, 2021, our board of directors nominated Dana Wolf to stand for election to the Board at the Annual Meeting. At the Annual Meeting, two Class II directorseach of the five recommended nominees, if elected, will be electedserve for a three-year term to succeed the same class whose term is then expiring.one-year term. Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.